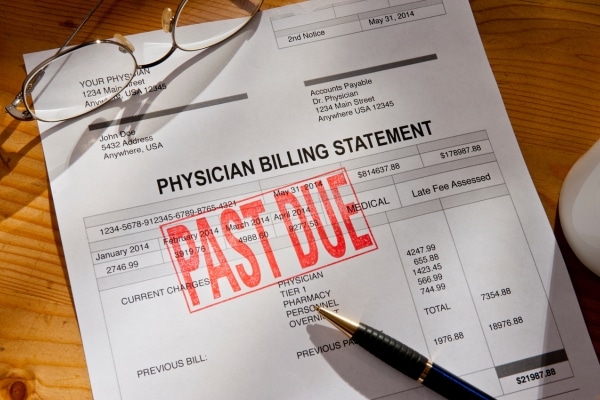

Medical bills can quickly spiral out of control, leaving many people struggling to keep up with payments. As healthcare costs continue to rise, even those with insurance may find themselves unable to cover their out-of-pocket expenses. When these bills go unpaid, they don’t just disappear; instead, they can lead to serious financial and legal consequences. Unpaid medical debt can lower credit scores, result in collection agency harassment, and even lead to lawsuits or wage garnishment. Understanding how medical debt impacts your life and knowing your rights can help you avoid devastating legal repercussions. Taking action early is crucial to preventing long-term financial hardship.

Contents

How Medical Bills Become Debt

Medical bills don’t turn into debt overnight, but once they go unpaid for a certain period, they can quickly become a financial burden. Hospitals and healthcare providers typically send multiple notices before considering a bill delinquent, often giving patients a few months to pay or set up a payment plan. However, if no payments are made, the outstanding balance is often handed over to a collection agency. At this point, the medical bill is no longer just an overdue charge—it becomes a debt that can impact your financial future.

Once a collection agency takes over, they have the legal right to pursue payment through various means. Frequent calls, letters, and emails are common tactics used to pressure individuals into paying their outstanding balances. While some agencies follow ethical practices, others may use aggressive or misleading methods to collect on the debt. If the balance remains unpaid for too long, further legal action may be taken to recover the money owed.

The Impact on Your Credit Score

Unpaid medical bills can significantly damage your credit score, making it harder to access loans, secure housing, or even get a job. While medical debt was once immediately reported to credit bureaus, recent changes now provide a grace period before it appears on credit reports. This delay gives individuals more time to resolve their debt before it affects their financial standing. However, once medical bills are reported, they can lower credit scores and remain on reports for up to seven years.

A lower credit score can have long-term consequences that extend beyond difficulty obtaining loans. Interest rates on existing credit cards and mortgages can increase, leading to higher monthly payments. Some landlords and employers check credit history, which means medical debt could affect housing opportunities and job prospects. Although some states have laws restricting how medical debt impacts credit scores, unpaid bills can still create significant financial strain.

Lawsuits and Wage Garnishment

When medical debt remains unpaid for too long, healthcare providers or collection agencies may escalate the situation by filing a lawsuit. Many people ignore collection notices, assuming the debt will be forgotten, but lawsuits can result in serious legal consequences. If the debtor does not respond to the court summons, a default judgment is often issued in favor of the creditor. This ruling allows creditors to take further action, such as garnishing wages or seizing assets, to recover the unpaid amount.

Wage garnishment is one of the most severe outcomes of a medical debt lawsuit, as it directly impacts an individual’s financial stability. If granted by the court, a portion of the debtor’s paycheck is automatically deducted and sent to the creditor. State laws vary on the percentage that can be taken, but garnishment can make it difficult to cover essential expenses like rent and groceries. While certain income sources, such as Social Security, may be protected, many individuals find themselves trapped in a cycle of financial hardship.

Liens and Property Seizures

In some cases, creditors can place a lien on a debtor’s property to secure payment for unpaid medical bills. A lien gives creditors a legal claim to a person’s home or other assets, preventing the owner from selling or refinancing until the debt is settled. This can be particularly damaging for homeowners, as it limits their ability to access equity or relocate. Even if the debt does not result in foreclosure, a lien remains attached to the property, making financial recovery even more difficult.

Although property seizures for medical debt are rare, they are not impossible. If a court grants a judgment in favor of the creditor, certain assets may be seized and sold to cover the outstanding balance. Vehicles, bank accounts, and valuable personal belongings can all be at risk, depending on state laws. For many people, this level of legal action adds further stress to an already overwhelming financial situation, making early intervention crucial.

Bankruptcy as a Last Resort

For individuals drowning in medical debt, bankruptcy may seem like the only way out. While it can provide relief by discharging medical debt, it comes with severe financial consequences that should not be taken lightly. Chapter 7 bankruptcy allows for the elimination of unsecured debts, including medical bills, but may require the liquidation of certain assets. Chapter 13, on the other hand, restructures debt into a repayment plan, allowing individuals to pay off what they owe over time while keeping their property. Each option has long-term effects that can impact financial stability for years to come.

Filing for bankruptcy significantly damages credit scores and remains on financial records for up to ten years. This can make it difficult to obtain loans, secure housing, or even qualify for certain jobs that require financial responsibility. Additionally, while bankruptcy eliminates medical debt, it does not erase other obligations like student loans or child support. Some people find that negotiating with creditors or setting up payment plans is a better alternative than filing for bankruptcy. Seeking financial counseling before making a decision can help determine if bankruptcy is the best path forward.

Government and Legal Protections for Medical Debt

Although medical debt can have serious consequences, several legal protections exist to help individuals manage their financial burdens. The No Surprises Act prevents unexpected medical bills from out-of-network providers, reducing the risk of excessive charges. Medicaid and hospital charity programs offer financial assistance for low-income individuals who qualify. Some states have laws limiting how aggressively hospitals and collection agencies can pursue unpaid medical debt. Understanding these protections can help individuals avoid unnecessary legal action and financial hardship.

Legal aid organizations can provide assistance to those facing lawsuits or unfair debt collection practices. The Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using harassment, threats, or deception to collect payments. In some cases, individuals can challenge medical bills due to incorrect charges, insurance errors, or unlawful collection tactics. Knowing your rights and seeking legal support when needed can prevent creditors from taking advantage of vulnerable individuals. Taking proactive steps can make a significant difference in managing medical debt before it escalates.

How to Avoid Legal Trouble from Medical Debt

Preventing medical debt from turning into a legal issue requires early action and careful financial planning. Negotiating with healthcare providers before a bill goes to collections can result in reduced payments or interest-free installment plans. Many hospitals offer financial assistance programs that can lower costs, even after treatment has been received. Reviewing medical bills for errors and disputing incorrect charges can prevent unnecessary expenses from piling up. Addressing these issues promptly can make it easier to manage medical expenses before they spiral out of control.

For those already dealing with collection agencies, open communication and strategic planning are key. Asking for a debt validation letter can ensure that the amount being collected is accurate and legitimate. Setting up a structured repayment plan can prevent the debt from progressing to lawsuits or wage garnishment. In some cases, debt consolidation may be an option for managing multiple medical bills in one affordable payment. Taking these steps early can help avoid the severe legal and financial consequences of unpaid medical bills.

Don’t Let Medical Debt Take Over Your Life

Unpaid medical bills can create a cycle of financial and legal trouble, but taking action early can prevent the worst consequences. Ignoring medical debt only gives creditors more power, leading to lawsuits, wage garnishment, and credit damage. Seeking financial assistance, negotiating with providers, and understanding legal protections can make a significant difference. While medical debt may feel overwhelming, there are ways to manage it without resorting to bankruptcy or losing assets. Taking control of medical expenses now can lead to a more stable and secure financial future.